PropNex Picks

|December 03,2025Recovery In HDB Resale Volume And Average Resale Price In November 2025

Share this article:

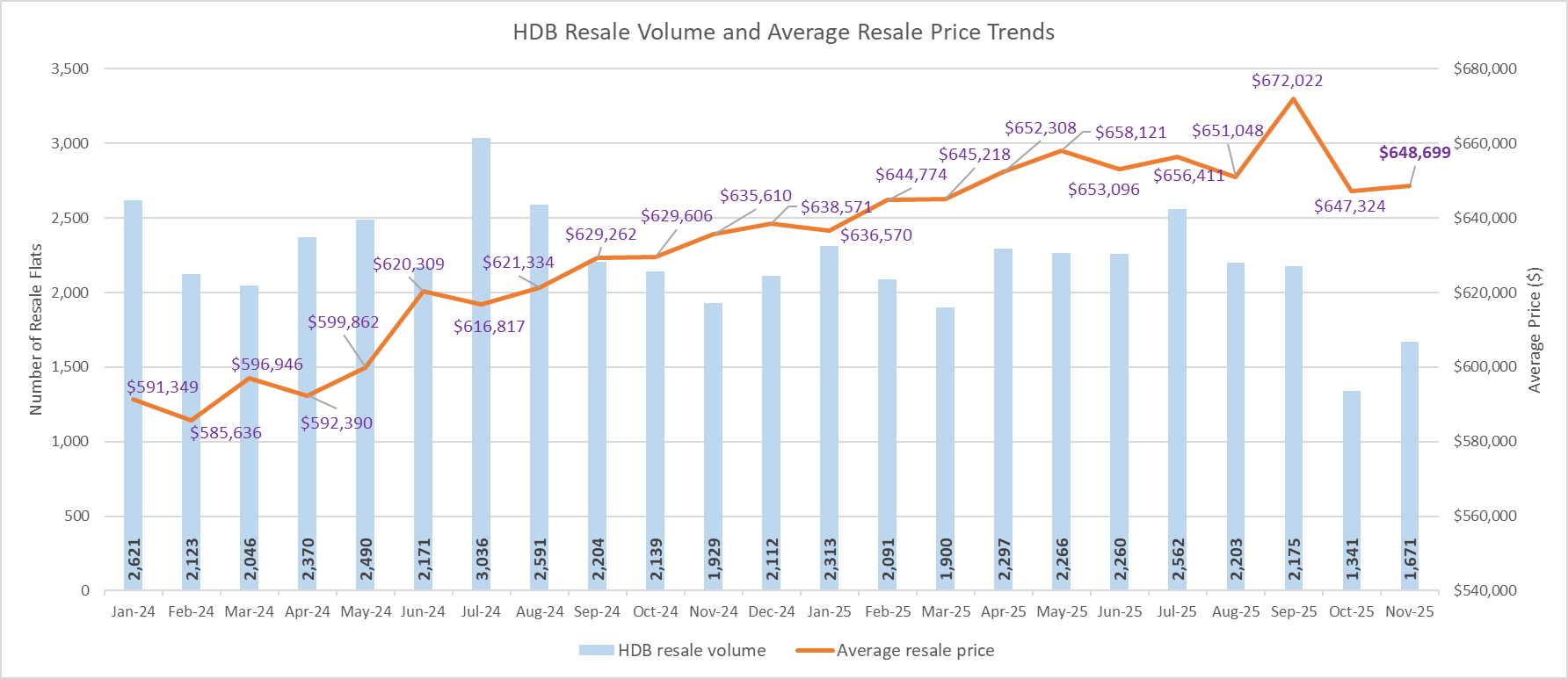

The HDB resale market activity picked up slightly in November 2025, following a substantial slowdown in transactions in the previous month. Notably, the HDB resale volumes in October and November are the slowest monthly tallies since April and May 2020, where the COVID-19 pandemic restrictions had hampered sales.

In November, there were 1,671 flats resold - up by 24.6% month-on-month (MOM) from 1,341 units transacted in October (see Chart 1). When compared with November 2024, sales were down by 13.4%. Meanwhile, the average resale price inched up by 0.2% MOM in November to $648,699 from $647,324 in October - helped by the recovery in transaction numbers. The most popular towns in November were Tampines, Yishun, and Woodlands.

Chart 1: HDB resale volume and average resale price

Several factors likely weighed on sales, including the ample supply of 9,144 new build-to-order (BTO) flats launched by the HDB in October. In total, there were 29,975 new flats introduced in 2025, comprising 19,723 BTO flats and 10,252 flats offered under the Sale of Balance Flats (SBF) exercises.

These new flats, including projects with shorter waiting times of three years or less could have enticed some prospective buyers to apply for them instead of purchasing a resale flat. In addition, the seasonal lull during the year-end, due to the school holidays and festive period could also have tamped down sales activity.

The HDB has said that 20,913 resale flats were transacted in the first nine months of the year. Taking in the 3,012 units resold in October and November, an estimated 23,925 resale flats have been sold in the January to November period. In all likelihood, the overall HDB resale volume for 2025 could underperform the 28,986 units resold in the whole of 2024.

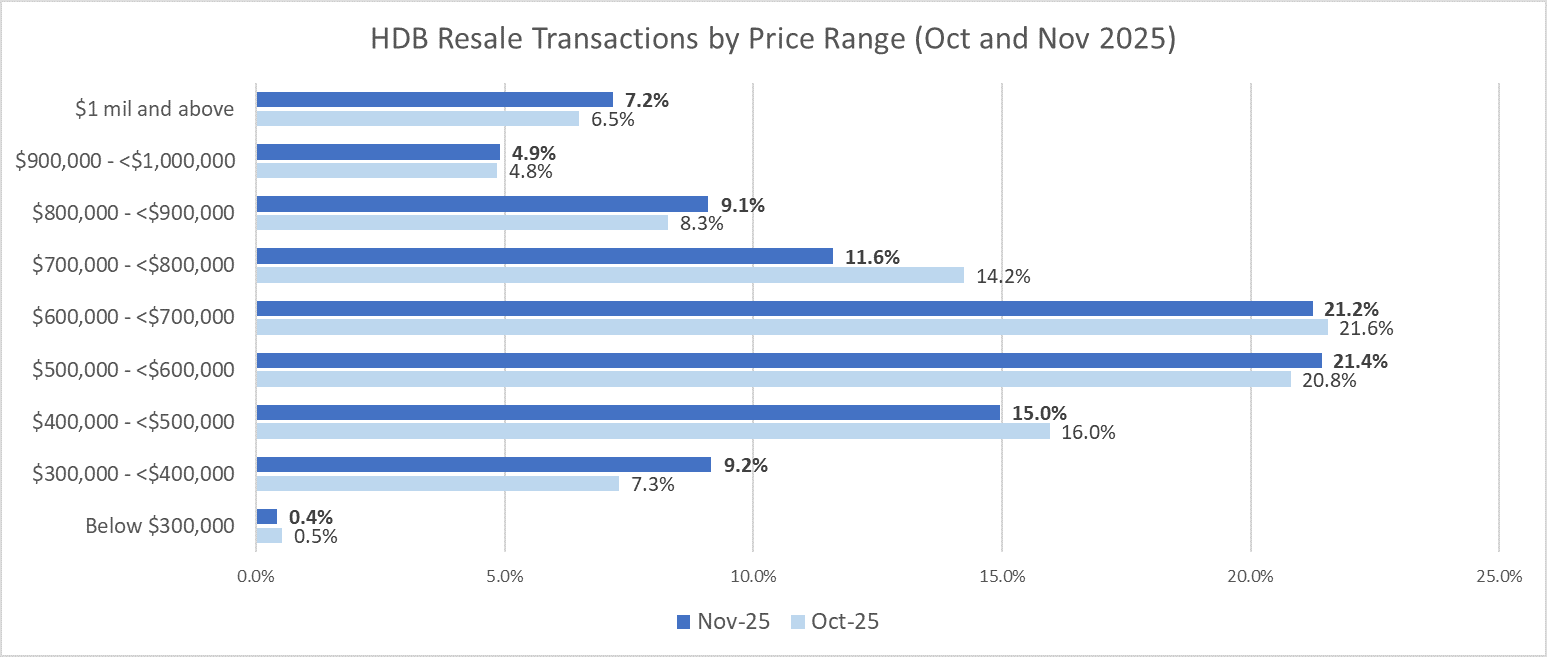

Transaction data showed that the proportion of flats resold that were priced at below $500,000 in November was 24.5% - a touch higher than 23.8% in the previous month. About 42.7% of the resale flats sold fetched between $500,000 and under $700,000, relatively in line with the 42.4% in October. Meanwhile, 25.6% of the transactions were priced at $700,000 to just under $1 million in November - down from 27.4% in the previous month. Of note, the proportion of flats resold for at least $1 million rose to 7.2% in November from 6.5% in October (see Chart 2).

Chart 2: HDB resale flat transactions by price range

By flat type and town classification, the 4-room flats resold in mature towns posted the sharpest month-on-month price growth of 2.6% to about $787,000 in November (see Table 1). This is followed by executive flats which booked a 1.5% MOM price increase to around $1.05 million. Over in non-mature estates, executive flats witnessed the strongest price growth at 2.5% QOQ to about $896,000.

Table 1: Average HDB resale flat prices by flat type, by town classification

| Mature towns | Non-mature towns | ||||

| Oct-25 | Nov-25 | % change MOM | Oct-25 | Nov-25 | % change MOM |

3 ROOM | $476,228 | $472,266 | -0.8% | $457,933 | $458,808 | 0.2% |

4 ROOM | $766,877 | $787,089 | 2.6% | $600,096 | $602,828 | 0.5% |

5 ROOM | $937,932 | $942,151 | 0.4% | $717,312 | $714,801 | -0.4% |

EXECUTIVE | $1,029,821 | $1,045,163 | 1.5% | $873,461 | $895,665 | 2.5% |

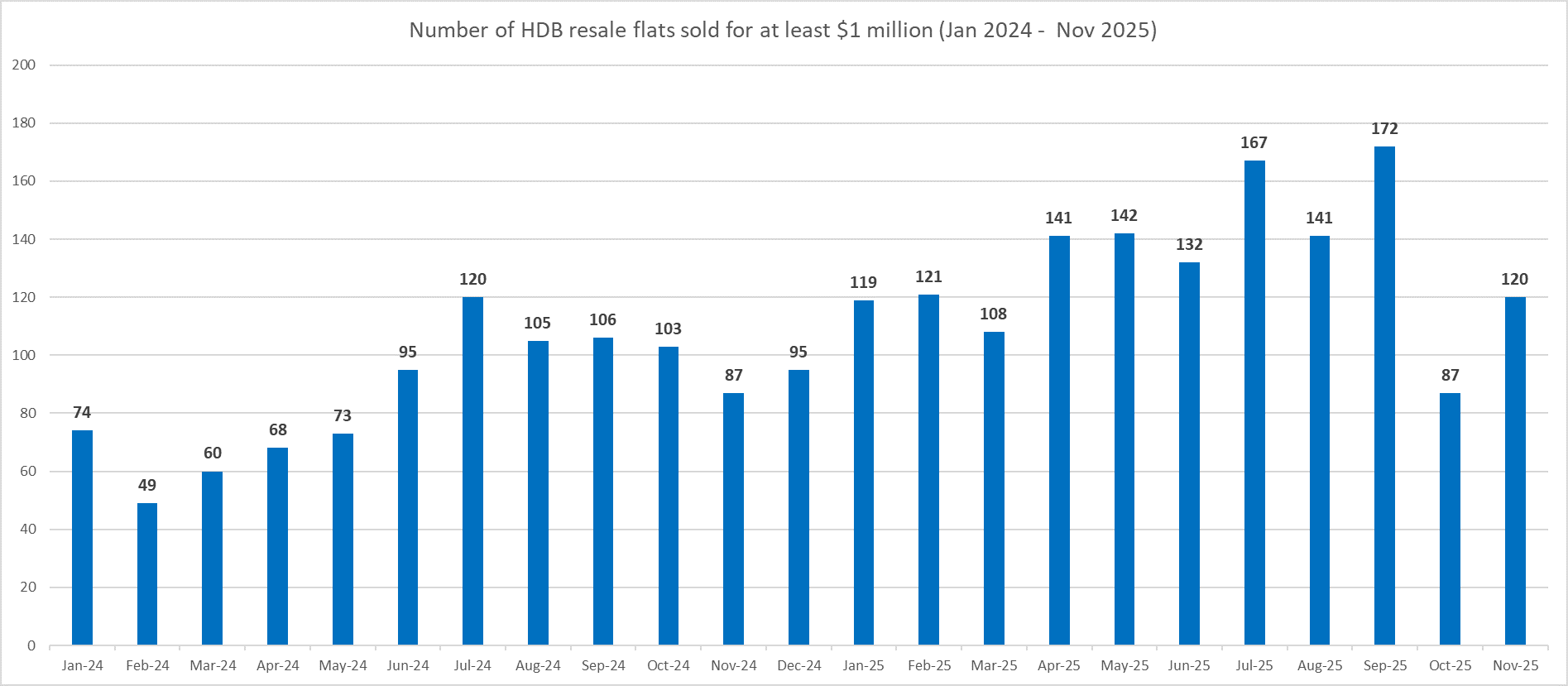

After the sharp fall in the number of million-dollar resale flats from September to October, such sales found renewed strength in November. There were 120 flats resold for at least $1 million in November - up by nearly 38% from the 87 units that changed hands in October (see Chart 3). The 120 units of million-dollar resale flats in November comprised a 3-room terrace flat, 50 units of four-room flats, 45 units of five-room flats, and 24 executive flats.

Among the million-dollar resale flat deals in the month, 13 units are located in non-mature towns - six in Hougang, two each in Sengkang and Yishun, and one each in Bukit Batok, Jurong East, and Woodlands. The rest of the units are in mature towns, led by Bukit Merah with 20 deals, followed by Toa Payoh and Queenstown with 17 and 16 such sales, respectively.

In the first 11 months of 2025, there were 1,450 units of million-dollar resale flats sold - up by 40% from the 1,035 units transacted in the entire 2024.

Chart 3: Number of HDB flats resold for at least $1 million by month

During the month, the priciest HDB resale flat transacted was a 5-room unit at Natura Loft in Bishan which fetched $1.63 million (see Table 2). The DBSS (design, build and sell scheme) unit which spans 120 sqm is located on a floor ranging between the 34th and 36th storey. It has a lease balance of 84 years and 10 months at the point of resale. Separately, an executive flat in Bishan St. 12 was resold for $1.6 million in November; the maisonette unit is sizable at 163 sqm, and is located on a high floor. These two deals are the most expensive resale flats transacted in Bishan towns to-date.

Table 2: Top 10 HDB resale flats sold in November 2025 by Transacted Price

Town | Type | Street | Storey range | Floor area (SQ M) | Lease start date | Resale price | PSF ($) |

BISHAN | 5 ROOM | BISHAN ST 24 | 34 TO 36 | 120 | 2011 | $1,632,000 | $1,263 |

BISHAN | EXECUTIVE | BISHAN ST 12 | 22 TO 24 | 163 | 1987 | $1,600,000 | $912 |

CENTRAL AREA | 5 ROOM | CANTONMENT RD | 16 TO 18 | 107 | 2011 | $1,490,000 | $1,294 |

CLEMENTI | 5 ROOM | CLEMENTI AVE 3 | 37 TO 39 | 113 | 2021 | $1,488,889 | $1,224 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 22 TO 24 | 113 | 2019 | $1,465,888 | $1,205 |

BISHAN | EXECUTIVE | BISHAN ST 23 | 16 TO 18 | 156 | 1992 | $1,460,000 | $869 |

TOA PAYOH | 5 ROOM | BIDADARI PK DR | 16 TO 18 | 114 | 2020 | $1,450,000 | $1,182 |

CLEMENTI | 5 ROOM | CLEMENTI AVE 3 | 07 TO 09 | 113 | 2021 | $1,448,000 | $1,190 |

QUEENSTOWN | 5 ROOM | DAWSON RD | 16 TO 18 | 107 | 2020 | $1,430,000 | $1,242 |

BUKIT MERAH | 5 ROOM | HENDERSON RD | 10 TO 12 | 113 | 2019 | $1,410,000 | $1,159 |

Bishan is one of the public housing estates that are popular among buyers, owing to a clutch of sought-after schools in the vicinity, including Raffles Institution, Raffles Girls' School (Secondary), Ai Tong School, Catholic High School, and Kuo Chuan Presbyterian Primary School. In addition, recent plans announced by the government to transform the Bishan town centre into a business and lifestyle hub under the Master Plan 2025 could also have further boosted the estate's appeal.

In view of year-end holiday and festive distractions, PropNex expects HDB resale activity in December to be relatively muted. Looking at 2026, the HDB resale segment could see further stabilisation with modest price growth, as the ample supply of new flats and existing policy guardrails keep the market in check.

Contact a PropNex salesperson to find out more about resale HDB market trends.